Sales tax exemption for your candle or soap business Are you paying sales tax on your supply orders when you don’t need to?

Running your small business involves balancing the creative joys of making with practical tasks like logistics and managing costs. And one place we’ve seen many business owners overlook a chance to save money is by trimming their expenses through sales tax exemptions.

If you’re a U.S.-based maker, you could be spending more on supplies than you should—because you’re unnecessarily paying sales tax. Read on to learn more about sales tax exemption and how to save by becoming sales tax exempt.

What is sales tax exemption?

Sales taxes are collected in most U.S. states and must be charged to the end-user of a good or service. They are commonly applied to purchases of tangible goods like clothes, appliances, and electronics, and are also charged for services like car repairs, as well as internet and cell phone service. Sales taxes are set by state and local governments. Many online businesses, CandleScience included, charge sales tax on most purchases to comply with a Supreme Court ruling.

But what about situations when goods are purchased by someone besides the end user? That’s where sales tax exemption comes into play.

Sales tax exemptions are exceptions to the rule that businesses must collect sales tax. These exemptions apply in a few specific situations and the most relevant situation to candle and soap makers is purchasing materials for production purposes. Those items are usually exempt from sales tax because they haven’t yet reached their final destination in the purchase chain.

Why does sales tax exemption matter to makers?

Sales tax exemptions save you money!

Remember, sales tax only needs to be collected during the final sale of a finished product to the end customer. Not at the intermediate stages of a product’s lifecycle like production (when a maker purchases raw materials from a supplier) or wholesaling (when a shop purchases the product from the maker to resell).

Supplies like wax, wicks, fragrance oils, candle containers, and packaging are components used in finished products. Therefore, you can defer sales tax on those purchases with a sales tax exemption.

All but five states in the U.S. collect sales tax and most sales tax rates are between five and seven percent. If you live in an area where the sales tax is 7% and you routinely place $500 orders, you’re paying an additional $35 on every order in sales tax. Say you order like this every month? You will spend $420 a year on sales tax alone—nearly the cost of a single supply order!

The cost savings associated with sales tax exemptions also mean you can gain a few percentage points in your profit margins. With the many costs of running a business, every little bit counts. So why not make sure you’re saving everywhere you can?

How do I become sales tax exempt?

Using sales tax exemptions to benefit your business’s bottom line is a no-brainer.

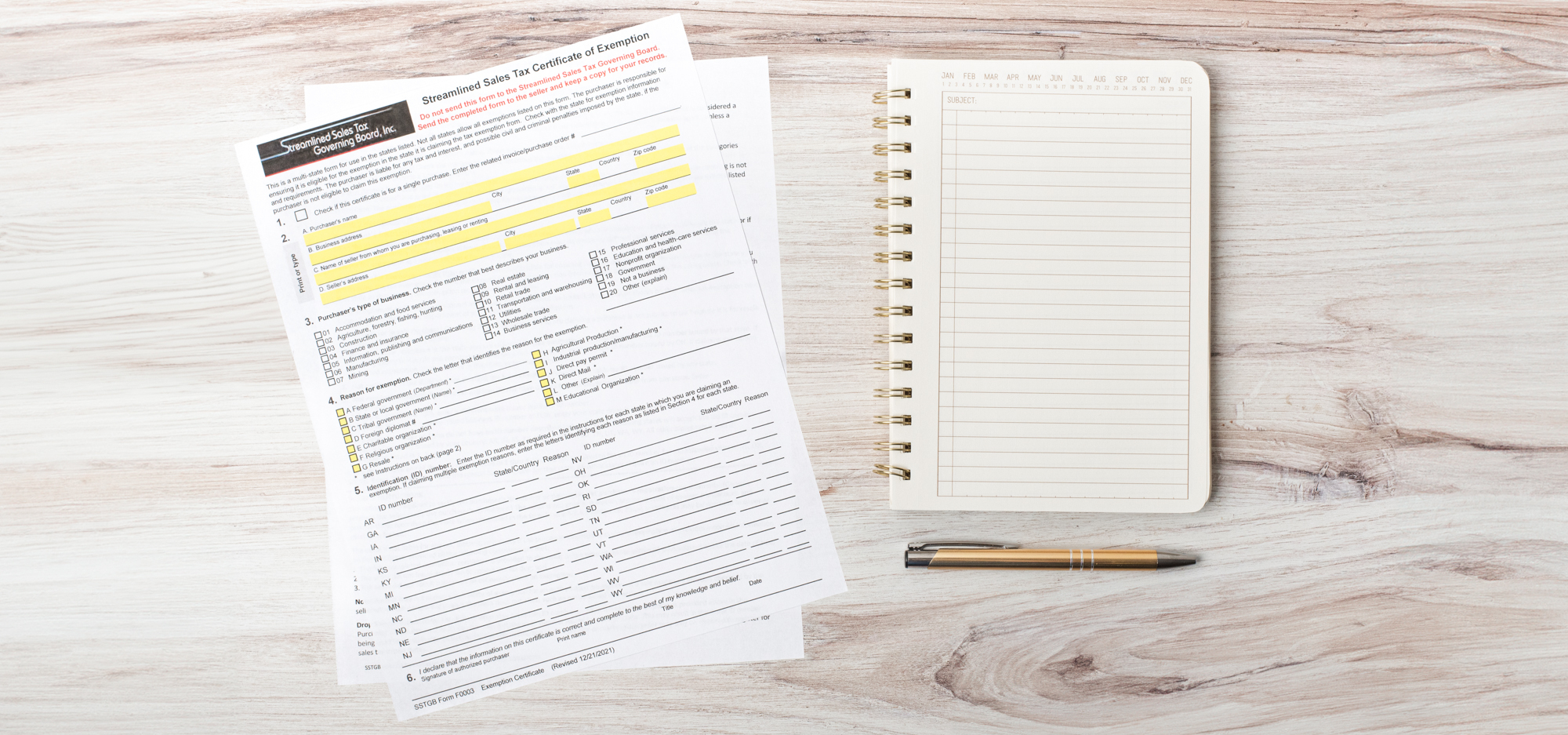

You will typically need to provide a state-issued document called a resale certificate to become exempt from sales tax on purchases made from a supplier for business purposes. This documentation may vary in name from state to state.

To determine the steps required to become sales tax exempt and to get answers to your questions about sales tax exemption, contact your state’s department of revenue, taxation, or finance.

Not necessarily! Sales tax is determined by each state and regulated at a state level. Your Federal Employer Identification Number is a federal registration. Your FEIN recognizes you as a registered business, but it does not mean you are automatically exempt from paying sales tax. The laws in each state vary, but most states will require you to apply for an additional license or certificate to be exempt from paying sales tax.

Once you have your resale certificate or documentation, you’ll need to register your sales tax-exempt status with the businesses you purchase supplies from. That way your future orders with them will not include a sales tax charge.

Sales tax exemption at CandleScience

Becoming sales tax exempt at CandleScience takes just a few steps. Get started here! At this time, we are not required to charge sales tax on orders shipping to Alaska, Delaware, Montana, New Hampshire, Oregon, and Puerto Rico.

Customers occasionally ask us how to get refunds for sales taxes they unnecessarily paid on past orders. Although we cannot issue those refunds, you may be able to file a refund request with your state. Contact your state’s tax or revenue agency to learn more.

Do you have more questions about sales tax and sales tax exemptions?

We put together this FAQ to help! Our Customer Support team is also available to assist.

Final thoughts on sales tax exemption

While the average sales tax rate may seem modest, the cumulative savings from exempting sales taxes on your supplies purchases can significantly impact your business over time.

By getting a resale certificate and using sales tax exemptions, you can optimize your purchasing, free up more money to put toward other parts of your business, and improve your profit margins in the process.

Have you taken advantage of sales tax exemptions for your candle or soap business? If so, what tips do you have for others starting the process? If you haven’t, what’s holding you back? We’d love to hear your experiences and any challenges you’ve faced. Drop your thoughts and questions in the comments below!

More resources for your business

Wholesale candle making supplies

Time-saving tips, tools, and strategies for candle makers & candle businesses